Introduction

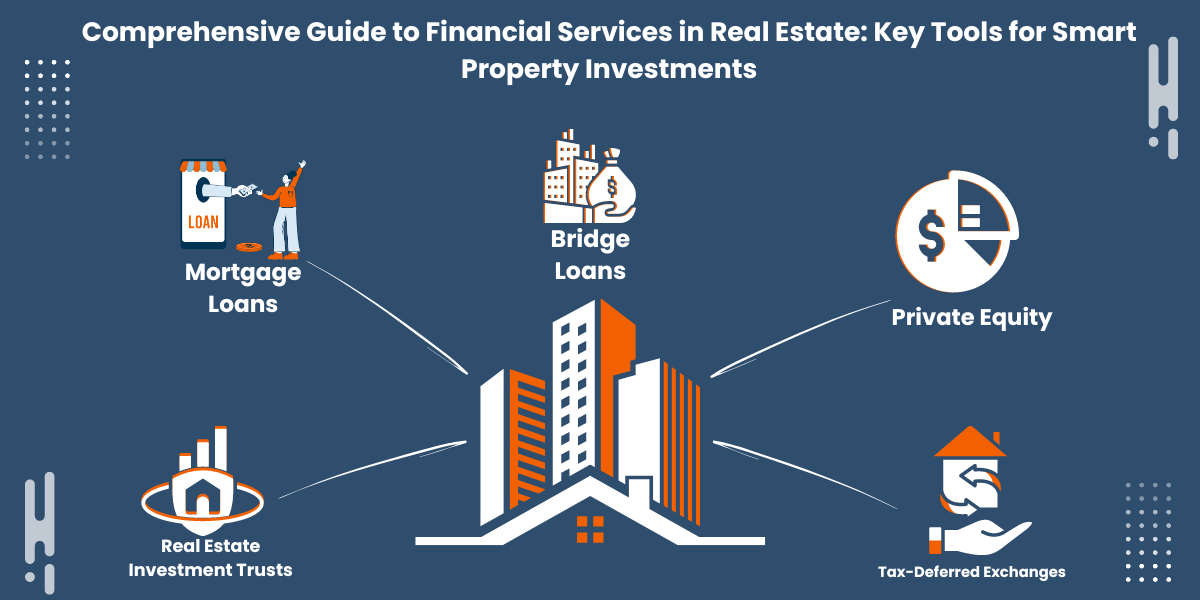

In the dynamic world of real estate, financial services are essential for facilitating property transactions, managing investments, and securing assets. Whether you’re a first-time homebuyer, seasoned investor, or real estate developer, understanding the financial services available in the real estate sector is crucial for making informed decisions and maximizing your returns. This guide will explore key financial services related to real estate, highlighting how they can support your property investments and overall financial planning.

1. Mortgage Financing: The Foundation of Property Investment

What is Mortgage Financing in Real Estate?

Mortgage financing is a loan provided by banks, credit unions, or other financial institutions to help individuals or entities purchase real estate. The property itself typically serves as collateral for the loan, providing security to the lender in case of default.

Types of Mortgage Financing:

- Fixed-Rate Mortgages: Loans with a consistent interest rate throughout the term, offering predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs): Interest rates on ARMs fluctuate based on market conditions, potentially offering lower initial rates but higher risk over time.

- Interest-Only Mortgages: Borrowers pay only the interest for a set period before principal payments begin, suitable for those expecting significant income growth.

How Mortgage Financing Benefits Real Estate Investors:

Mortgage financing allows investors to leverage their capital, enabling the purchase of properties they might not afford outright. By carefully selecting the right mortgage product, investors can optimize cash flow, manage debt effectively, and potentially increase their returns on investment.

2. Real Estate Investment Trusts (REITs): Diversifying Investment Portfolios

What Are REITs?

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate. By investing in a REIT, individuals can gain exposure to real estate assets without having to buy, manage, or finance any properties directly.

Types of REITs:

- Equity REITs: These REITs own and manage income-generating real estate, such as office buildings, shopping malls, and residential apartments.

- Mortgage REITs: These REITs provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities.

- Hybrid REITs: A combination of both equity and mortgage REITs, offering diversified exposure to both property ownership and mortgage financing.

Benefits of Investing in REITs:

- Diversification: REITs allow investors to diversify their portfolios by gaining exposure to real estate without the need to own physical properties.

- Liquidity: Unlike direct real estate investments, REITs can be bought and sold like stocks, offering greater liquidity.

- Regular Income: REITs typically distribute a significant portion of their income as dividends, providing investors with a steady income stream.

3. Property Insurance: Safeguarding Real Estate Investments

The Importance of Property Insurance in Real Estate

Property insurance is essential for protecting real estate investments from risks such as fire, theft, natural disasters, and liability claims. It ensures that the investor’s capital is protected, even in the face of unexpected events.

Types of Property Insurance:

- Homeowners Insurance: Covers residential properties, providing protection against damages to the home and personal property.

- Landlord Insurance: Offers coverage specifically for rental properties, including protection against tenant-related damages and loss of rental income.

- Commercial Property Insurance: Designed for commercial real estate, covering buildings, equipment, and inventory.

How Property Insurance Supports Real Estate Investors:

By securing appropriate property insurance, real estate investors can mitigate risks and protect their investments from potential losses. It also provides peace of mind, knowing that their assets are safeguarded against unforeseen events.

4. Real Estate Loans: Financing Development Projects

What Are Real Estate Loans?

Real estate loans are specialized financing options designed for property development, construction, and large-scale real estate projects. These loans are typically used by developers, builders, and investors involved in commercial or residential property projects.

Types of Real Estate Loans:

- Construction Loans: Short-term loans that provide funding for the construction of new buildings or major renovations.

- Bridge Loans: Temporary financing options that bridge the gap between the purchase of a new property and the sale of an existing one.

- Permanent Loans: Long-term loans that replace construction loans once a project is completed, typically with fixed or adjustable interest rates.

Benefits of Real Estate Loans for Developers and Investors:

Real estate loans offer the capital necessary to undertake large-scale property projects. By leveraging these loans, developers and investors can take on ambitious projects, expand their portfolios, and potentially achieve significant returns on investment.

5. Real Estate Tax Services: Maximizing Tax Efficiency

The Role of Tax Services in Real Estate

Tax planning is a critical aspect of real estate investment. Real estate tax services help investors and property owners navigate the complexities of tax laws, optimize deductions, and ensure compliance with regulations.

Key Tax Services for Real Estate Investors:

- Property Tax Management: Assistance with property tax assessments, appeals, and payments to ensure fair taxation.

- Tax Deductions and Credits: Guidance on claiming deductions and credits for mortgage interest, property depreciation, and other eligible expenses.

- Capital Gains Tax Planning: Strategies to minimize capital gains taxes when selling investment properties.

How Tax Services Enhance Real Estate Investment Returns:

By utilizing professional tax services, real estate investors can maximize their tax efficiency, reduce liabilities, and increase their overall returns. Proper tax planning also helps in making informed decisions about property acquisitions, sales, and long-term investment strategies.

Conclusion

Financial services are the backbone of successful real estate investment and development. From mortgage financing and REITs to property insurance and tax planning, these services provide the tools and security needed to navigate the complex real estate landscape. By understanding and leveraging these financial services, investors can make smarter decisions, protect their assets, and ultimately achieve greater success in their real estate ventures.